I'm gonna tell you guys about wine investing. Wine is otherwise known as the true "liquid gold" of course it should be called so, with rare vintages going for an extraordinary 3,000 a bottle these days.

It all starts at the vineyards. Some vineyards produce good wines, some produce those 12 dollar varieties you can buy at 7-11 varieties. Different vineyards have different techniques and signature tastes. Now, once the wine is produced, let's say this year 2005. The wine has to be sold. So, the vineyard holds a sale where brokers come in to purchase it at the cost price (lowest price it can ever cost). Here's where we come in.

It all starts at the vineyards. Some vineyards produce good wines, some produce those 12 dollar varieties you can buy at 7-11 varieties. Different vineyards have different techniques and signature tastes. Now, once the wine is produced, let's say this year 2005. The wine has to be sold. So, the vineyard holds a sale where brokers come in to purchase it at the cost price (lowest price it can ever cost). Here's where we come in.

For good wines, a 2005 wine cannot be sold in 2005. No one's gonna drink it, so the merchants won't buy it. Wine takes a good 2-3 years to achieve minimum maturity and so someone has to hold the wine for these 3 years before releasing it for sale to the merchants. Who does the holding? Not the vineyards..they aint got the space to store and produce yearly harvests of new wines. So we do.

And the benefit of doing so? Well...in that 3 years where you pay for the storage and insurance of your premium wine, the added value is almost a good 10-15%! So, when I say confirmed profit. I mean this. Now, of course store it properly la..with proper humidity and temperature control so the labels dont get mouldy and the corks dont get damaged. BTW, even premium wine manufacturers are gravitating towards plastic screw caps for their bottles now..dont know if the fad will catch on though.

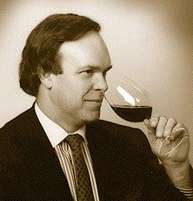

So, now you are sitting on a 15% capital gain in just 3 years. OK, some fixed deposits can do better. But, now comes the investor choice-information portion. The selection of what wine to buy. Thousands of vineyards, lotsa varieities of wine. Which is the best ? Hither come the "Million Dollar Nose" - Robert Parker Jr.

Parker is the supremo in wine ratings. He just woke up one day and decided to be the only fella who is ever gonna rate wines. And he does it professionally too, his ratings are the only ones to go by in the wine world. Every wine has a base rating of 50, one's above 90 are considered exceptional, above 95 are a collectors' item liao. So, if the wine u initally purchased was a 90 pointer and above [I personally only buy 92 pointers and above], you're in for another great price increase. Imagine, if your bottle of wine was bought at $40 and in 5 years is worth $1000. Hmm, you do the math.

Ultimately, everyone has their whims on where to make the most money. But for a stable and worthwhile investment, also if you are an avid wine drinker, a good bargain. Try wine. Ask me if you need any clarifications on how to start your own portfolio, might even let you buy into mine. I'll leave you with my final thought :

No comments:

Post a Comment